VEHICLE EQUITY

Use your car as collateral to get cash fast*

Better Business Bureau

from 6,500+ reviews

No impact to your credit score when you check your rate!

What can I do with a Best Egg Vehicle Equity Loan?

1

Use your car to access money

Take advantage of your paid-off vehicle’s value for the potential to get lower rates and higher loan amounts than unsecured offers may provide.2

Get better terms for your auto loan

Refinance an existing auto loan to score a lower APR, more affordable monthly payment, or free up cash by extending the loan term.3

Refinance your auto loan and request additional cash

Refinance an existing auto loan and request additional money to accomplish your goals.Fast-track your financial goals

By leveraging your vehicle’s value, you unlock the potential to score lower rates and higher loan amounts than our unsecured personal loans.

Whether you own your car outright or are paying it off, a Best Egg Vehicle Equity Loan could quickly give you the money you need to consolidate debt, finance a major purchase, and more.

See if you qualify with no impact to your credit score

Predictable monthly payments with a fixed interest rate

More flexible approval standards than our unsecured personal loan offers

Access up to 250% of your vehicle’s value (max. $100,000)

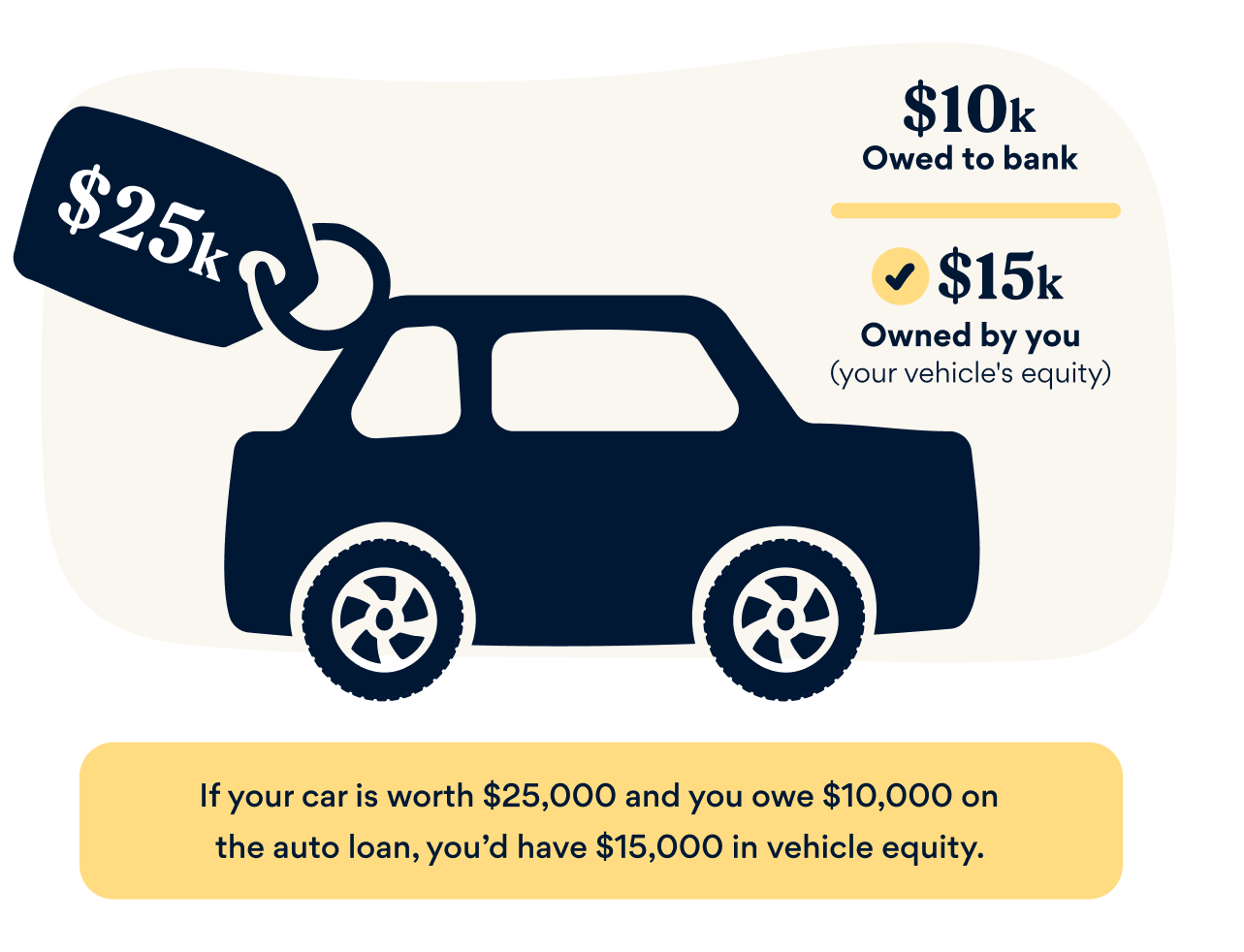

What is vehicle equity?

Vehicle equity is the value of your car after you subtract anything you owe on it. If you own your car outright with no loans or liens, your equity is 100%. If you’re paying it off, you can subtract your loan balance from the car’s current value to find your equity as a dollar amount.

Learn moreWhat to think about when considering

a vehicle equity loan

1

How much equity do you have in your car?

With a vehicle equity loan, you can borrow up to 250% of your car’s value. Knowing the amount of equity you’ve earned can help you estimate your potential loan amount.

2

Is your ownership title clean?

Your vehicle can’t have a salvage status or flood or hail damage to qualify for this loan. If you’re not sure, check your ownership title to see if any statuses are listed.

3

Do you know the estimated value of your car?

Use a vehicle valuation tool and browse online listings for your specific make, model, and year to get an idea of your car’s current value.

4

Are all your vehicle documents registered in the same state?

All documents must be issued by the state corresponding to your address, including your vehicle title, registration, insurance, and Driver’s License or ID.

If there is a co-owner, their Driver’s License or ID must also be issued in the same state.

Access your money, keep driving your car

Compared to a traditional title loan, a Best Egg Vehicle Equity Loan could be a smart choice.

Fixed APRs for predictable monthly payments

Flexible loan terms with no prepayment penalties

Ability to find a loan that fits your budget and cash flow

How it works

Tap into your vehicle’s equity in 5 steps

Find a loan that makes sense for you

With so many options, choosing the right loan for your needs can get confusing. Let’s break down the types of loans we offer and find the one that suits you best.

Explore options